- #COMPARE CAR INSURANCE QUOTES OHIO DRIVERS#

- #COMPARE CAR INSURANCE QUOTES OHIO FULL#

- #COMPARE CAR INSURANCE QUOTES OHIO FREE#

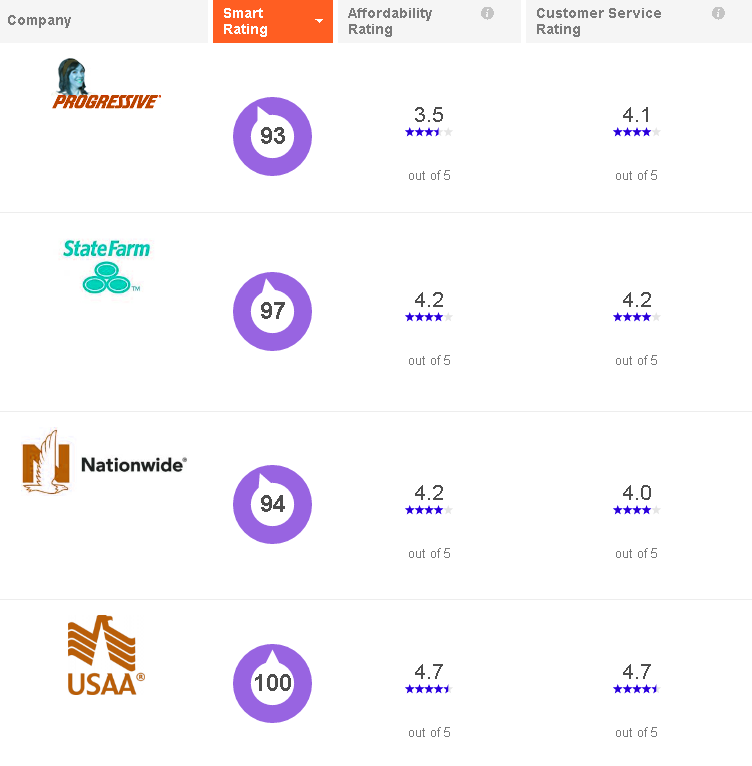

Many insurers also factor in your gender, with male drivers frequently paying more than female drivers. Drivers in Iowa and Wyoming enjoy some of the lowest rates and those in Florida and Michigan have some of the highest average rates, according to our analysis.Īnnual car insurance cost (minimum coverage)Īnnual car insurance cost (full coverage)Ĭompare car insurance rates by age and genderĪuto insurance companies always factor a driver’s age in when determining rates, with teen and young adult drivers paying more for coverage because they lack experience behind the wheel. Where you live will play a big role in how much you pay for coverage. Compare car insurance rates by company.Ĭompare rates offered by participating partners.To help you see how those factors may impact your rate, we collected data from top car insurance companies to provide average rates: There are several factors that can influence your car insurance rates, including your age, gender, location, credit history and driving record. Most major car insurance companies make it easy for you to get a quote online. It’s important to compare car insurance quotes and companies to make sure you’re getting the best price for your coverage needs.

#COMPARE CAR INSURANCE QUOTES OHIO FREE#

#COMPARE CAR INSURANCE QUOTES OHIO FULL#

Get free quotes from many different insurers, both local and national, and study these quotes to see which insurer is going to help you get the best deals and learn about full coverage auto insurance details in Ohio.

One of the best ways to make sure that you have enough coverage and that you aren’t paying too much for it is to shop around. A bond in the amount of $30,000 that is issued by an insurance company.A self-insurance certificate you can apply for through the BMV if you have more than 25 vehicles that are registered in your own or in a company’s name.A certificate from the BMV in the amount of $30,000 that is signed by two people who own real estate valuing a minimum of $60,000.A certificate from the BMV received after application and approval that shows that there is $30,000 deposited with the office of the Treasurer of the State of Ohio that will cover expenses if you are at fault in an accident.If you have decided that you are going to opt for a bond rather than insurance coverage, you have the following options: Rather than have this happen to you, it is best to try to get as much additional coverage as you can afford. You will probably be sued for damages, and when there are no funds to cover these damages, at fault drivers can lose their assets, including homes and cars, and they could end up with garnished wages. If you don’t have enough coverage, you could end up losing a lot. While it is alright to only have the minimum amount of insurance that is required, if you can afford it, you should try to have additional coverage, and why you should learn more about full coverage insurance details in Ohio. Property Damage Coverage – $7,500 for damage or destruction of property belonging to others as a result of an accident.Bodily Injury Liability – $12,500 per person injured in an accident, with a total of $25,000 for all persons injured in said accident.

0 kommentar(er)

0 kommentar(er)